Gemini vs Coinbase - Which is Best For Americans?

I have extensive use of both Gemini and Coinbase so in this Gemini vs Coinbase review, I'll breakdown the essential differences between these two popular crypto exchanges. In short, I'm partial to using Gemini because they have an excellent credit card where you can earn up to 3% of Bitcoin on select purchases and they are a well regulated trust company in the state of New York.

Coinbase by contrast is a publicly traded company (so you can trust them as a fiduciary with your assets) in the United States but currently they do not offer the same extra features that Gemini does. For example, Coinbase created the stablecoin USD Coin (USDC) but had their interest bearing accounts stopped by the SEC in the United States.

However, if you're simply looking for a crypto gateway to buy Bitcoin or to dollar cost into Bitcoin regularly both are excellent platforms. But I like Gemini for their ease of use to switch between standard Gemini and their "active trader" platform where you can place market orders that have much lower fees.

Coinbase vs Gemini Overview

Gemini and Coinbase make it simple and secure to buy, hold and trade Bitcoin. As exchanges tend to attract both new and seasoned buyers, both platforms have a simple and "pro" version of their platform. Each advanced platform (Gemini Active Trader and Coinbase Pro) offer lower fees when executing market orders.

Coinbase is one of the most popular, well-known centralized exchange that was founded in 2012 and follows stringent U.S. rules. Coinbase is backed by significant banking systems, such as J.P. Morgan and both platforms allow for access to advanced trading options.

Although the platforms are comparable, there are some notable differences. Gemini offers institutional investors with extra services, whereas Coinbase allows you to trade while learning. Both platforms will be simple for complete beginners to use. Coinbase has an edge overall owing to its availability in additional countries and offering more currency types.

To assess the overall cost of trading, experience and ease of use at both Gemini and Coinbase, I will compared them to one another across multiple dimensions. I’ll also looked at:

-Payment options

-Costs for various trading quantities and volumes

-Cryptocurrencies supported.

-Overall ease of use and support.

-Distinguishing characteristics I like

Security features are also factors in my evaluation. In addition, I’ve analyzed customer service as well as the usability of their platform (both have average at best customer support).

Account Creation and Security

Both exchanges are well developed with advanced security measures and adhere to US regulations and safety measures making them both a trustworthy option. When you sign up for each you’ll need to provide information to complete KYC regulations, contact information, an email and phone number.

I found the process of signing up to Coinbase to be faster overall as Gemini took up to a week to approve my account. Gemini also required me to provide a video screenshot of my face using my laptops web cam as part of the sign up process where Coinbase did not. However, both crypto exchanges require you to upload some sort of legal ID to prove your identify.

For this you can upload a picture of your passport or your state drivers license. Once your account is setup however both platforms are easy to use and navigate.

Gemini account security

When you create your Gemini account you’ll need to setup 2FA for enhanced security. The app the Gemini platform uses is the Authy app. What Authy does is it provide an added layer of account security when logging into your Gemini account as you’ll need to confirm your logging in via Authy.

You’ll also have to confirm all transaction on the Gemini platform via the Authy app so if your account is in any way ever compromised your funds will be secure as no one can initiate a transaction if they don’t have access to your linked Authy app on your phone.

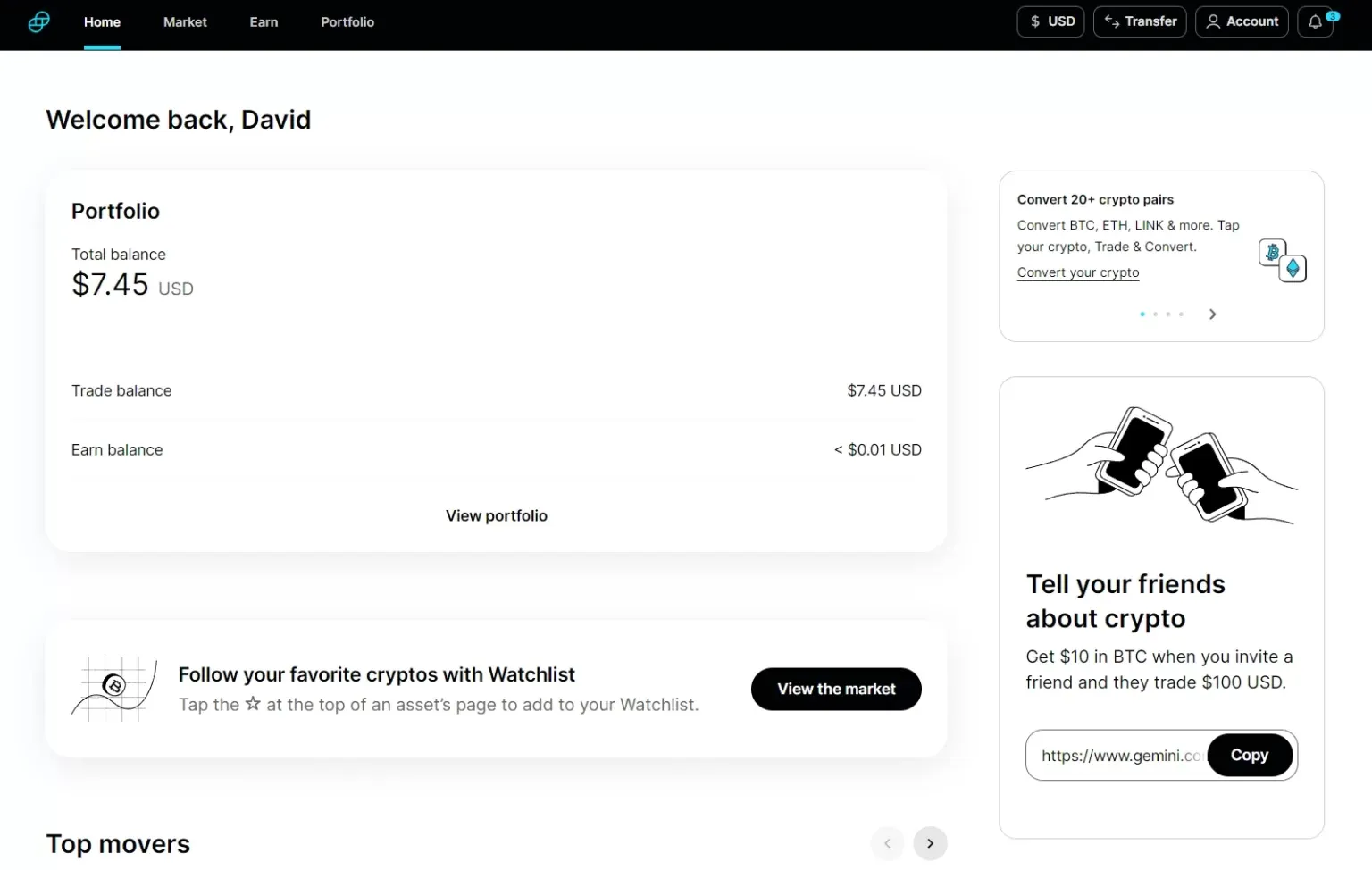

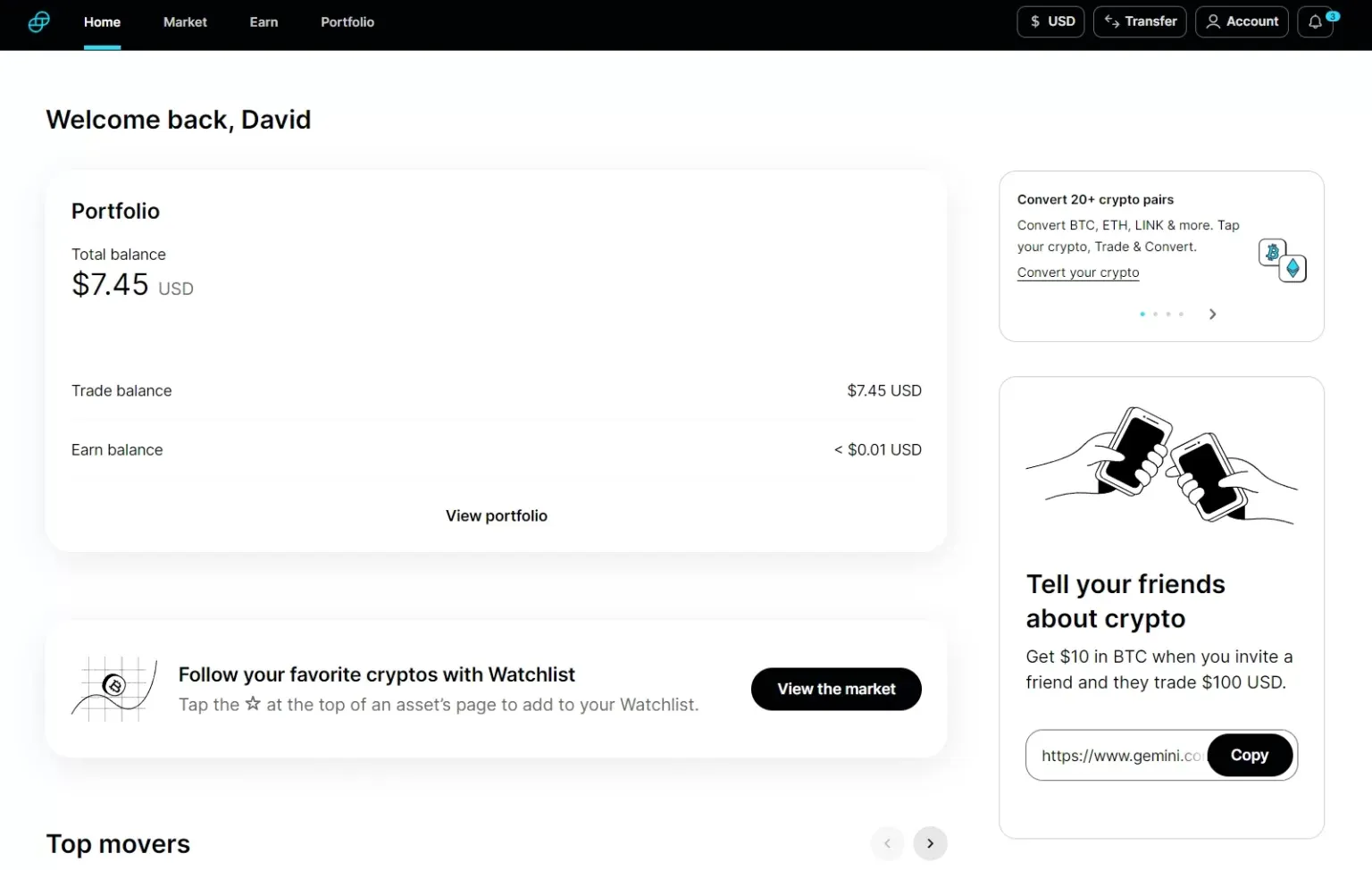

Apart from that you account comes with all the basic features you would expect:

- Home – A broad overview of your earn balance and trade balance.

- Market – View the crypto market for the latest movements.

- Earn – Gemini provides an opportunity for you to earn yield on your funds.

- Portfolio – The current balance of funds you hold on Gemini

To add and withdraw funds is quite a simple process as well. Simply click on the “transfer” button in the top right menu and select the currency you wish to withdraw and to what location. For something like Bitcoin you’ll have to put in a wallet address, for fiat currency you can sent to your linked checking account.

Coinbase account security

Coinbase account creation is much faster than Gemini. They don’t impose that you take a screenshot of your face when signing up and they also don’t require you to setup 2FA as part of the onboarding process.

This overall makes for a less technical and easy to use platform. However, once you start to buy Bitcoin and other digital assets you should setup 2FA for security purposes. Otherwise, anyone who discovers your email and password can transfer funds off your account.

The 2FA app that Coinbase uses is the Microsoft Authenticator app which you can download and the link to your account via a QR code.

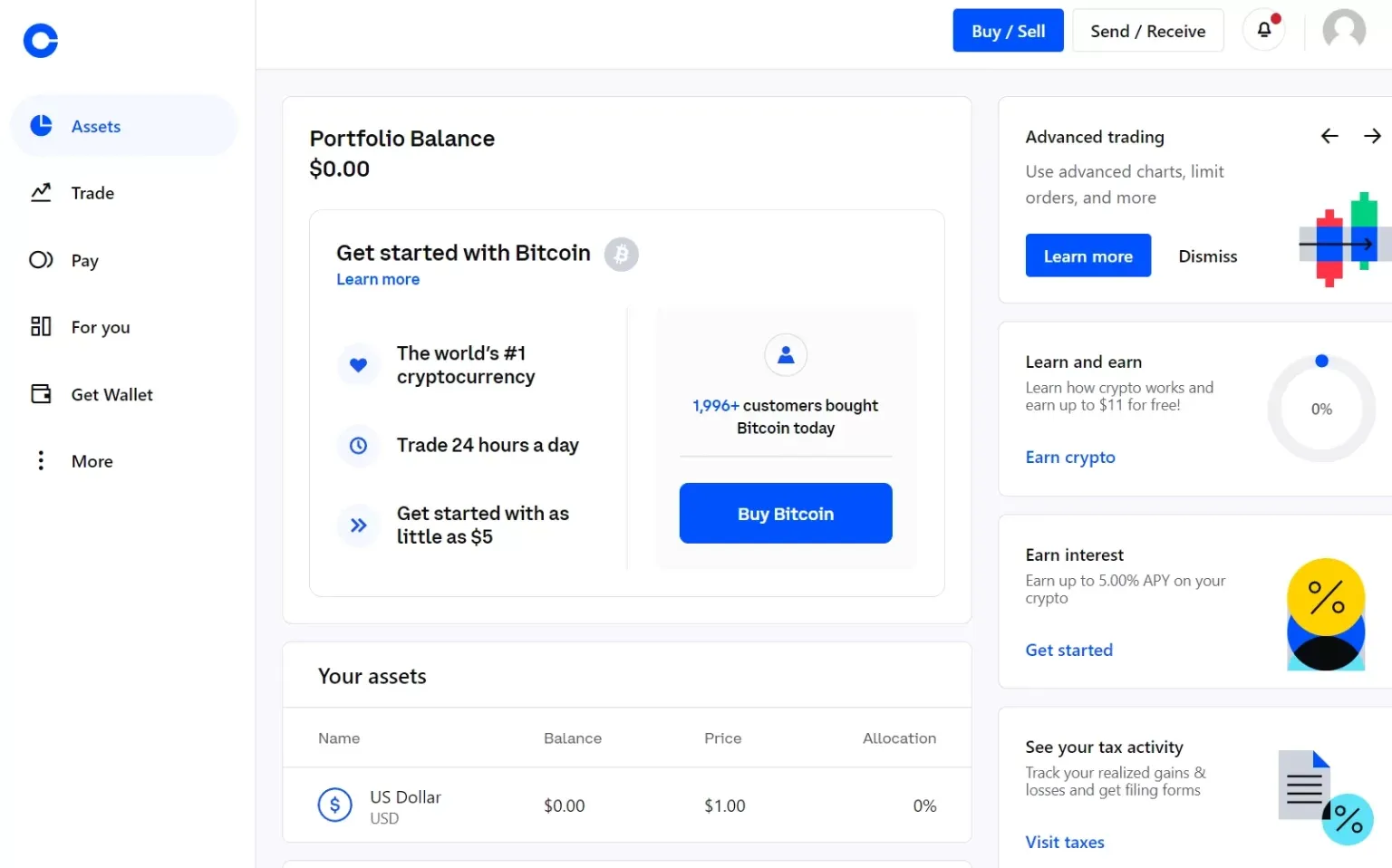

Within your Coinbase account you’ll notice a few navigation items:

- Assets – This is you dashboard and account overview.

- Trade – Under this tab you can buy and sell various crypto currencies

- Pay – Here you can send and receive cryptocurrency.

- For You – Latest news.

- Wallet – A link to the Coinbase browser wallet.

With your Coinbase account you can easily buy, sell, send and receive crypto currency. You also get access under your account to taxes and reports for accounting purposes.

Winner: Gemini

Both platforms require KYC information and Gemini does take a bit longer to approve your account but the overall security measures of using Authy are superior.

Authy is the best authenticator app, it provides backups and make it easy to change phone numbers and emails for when you purchase a new phone. I also like that you’re required to setup 2FA upon account creation. 2FA is absolutely required for security purposes for buying, selling, sending and receiving crypto currency.

Fees for Buying and Selling Crypto Currency

Coinbase and Gemini differ from other well-known exchanges in that they charge steeper fees. On the regular platform, Coinbase now has a maker-taker fee structure. Previously, this was solely done on Coinbase Pro. Now for trades expect to pay .5% on Coinbase, less the larger your trades are.

Gemini’s cost structure is intricate as well, especially for smaller transactions. Small flat fees are charged in a variety of amounts for trades under $200. Trades over $200 incur a 1.49 percent fee. However, by using the Gemini Active Trader platform (their equivalent to Coinbase Pro), which takes advantage of a maker-taker strategy, has lower costs than Coinbase.

If you use the Gemini API and pay by wire transfer on a regular basis, you’ll save money because it does not charge fees for wire transfers, whereas Coinbase does. Gemini API users may also have lower costs than web or app based users.

Funding your account

Both platforms allow you to fund your account through ACH transfer, a credit card, debit card, wire transfer and selling of crypto currency. The best way for both platforms is to use an ACH transfer by connecting your checking account to the exchange through Plaid. The cost of funding your account this will will be zero fees.

| Fees | Coinbase | Gemini |

| Debit/Credit Card | 3.99% | 3.49% |

| ACH Transfer | Free | Free |

| Crypto conversion | 0.50% | 1.49% |

In short it’s way too expensive to use a credit card to fund your account. Crypto conversions are also quite expensive on Gemini so I would suggest another platform if you wish to swap one currency for another.

When I get tipped in Basic Attention token (BAT), those tips go directly to my Gemini account. I then send that BAT to a Cefi platform like Blockfi to then use that BAT to buy Bitcoin at no additional cost, avoiding the 1.49% fee.

If you’re looking to fund your exchange account, the best way to do so is an ACH transfer. Both Gemini and Coinbase are FDIC insured on all USD balances held on their platforms and you can withdraw any funds you add at any time.

Fiat currency accepted

Coinbase supports over 100 countries where Gemini currently supports 60 different countries. As such a lot of users may not have access to Gemini.

The Gemini exchange currently accepts USD, CAD, EUR, GBP, AUD, SGD, and HKD. Coinbase by contrast supports USD, GBP, and EUR.

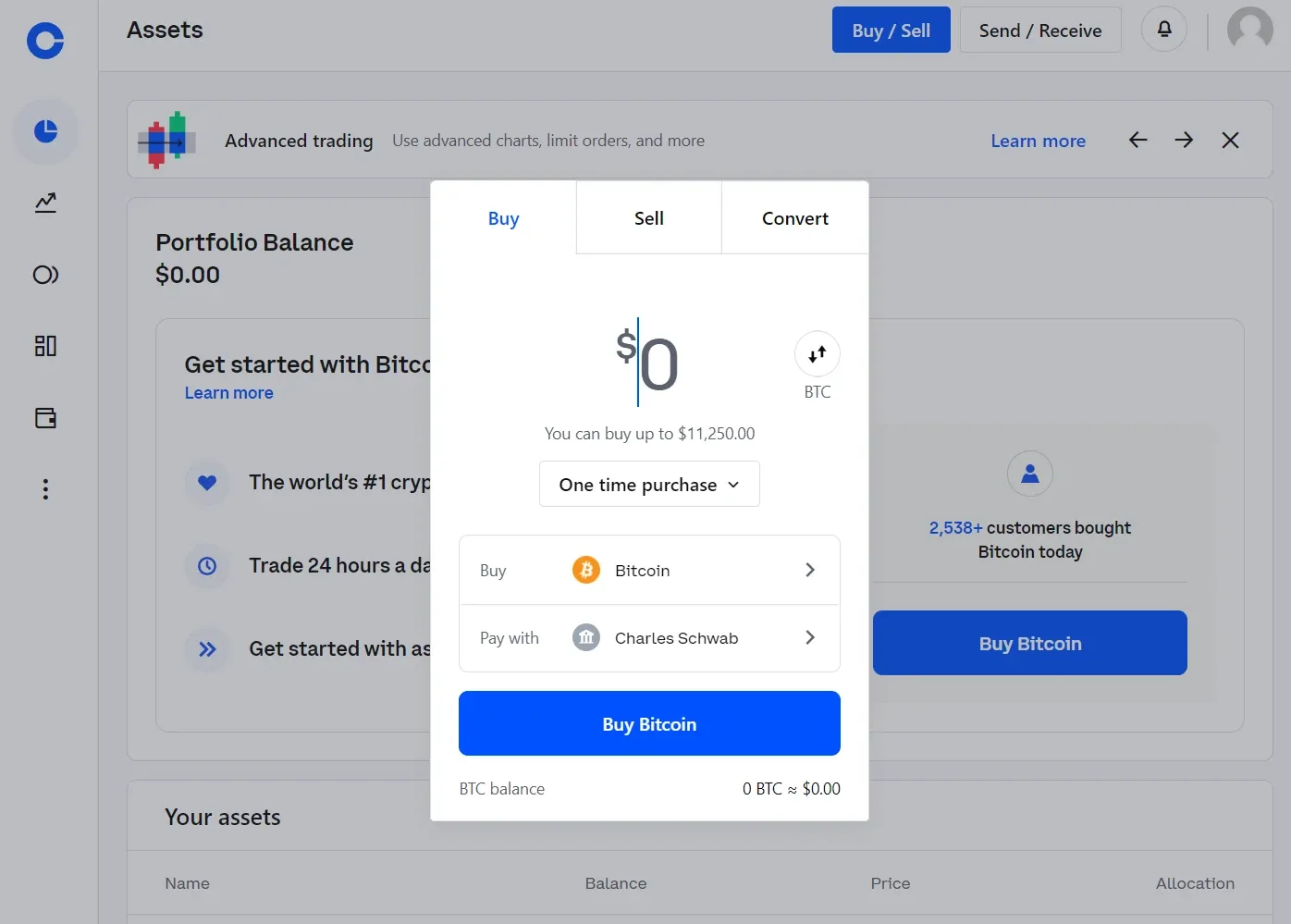

Buying Bitcoin with Coinbase

To buy you digital asset of choice is easy with Coinbase. Click on the blue “buy/sell” button at the top and a light box will appear that allows you to buy crypto with your funding course of choice. When making a purchase you’ll need to confirm your order if you have 2FA setup as well.

Buy crypto with Gemini

To buy crypto currencies on the Gemini platform you’ll need to navigate over to the market tab and the click on the asset you wish to purchase. You can also setup the ability to dollar cost into a select currency through this interface as well as transfer any purchases to Gemini Earn.

Fees for selling

Both platforms add maker and taker fees when you initiate a sell order for crypto currency for cash.

For Coinbase if you take an order at the market rate that is filled immediately, you are a taker and will pay a fee between 0.05 percent and 0.60 percent. When you create an offer that isn’t immediately matched by another one, it goes on the order book. If another client places an order that is similar to yours, you are the maker and will pay a charge between 0.00% and 0.40%.

Gemini’s trading fees are determined using a maker-taker fee system. All Orders are charged differently depending on whether they create liquidity or take it away. If you submit an Order that is immediately filled, you are considered a taker and will be charged a taker fee.

A maker is someone who places an Order that isn’t immediately filled but rather sits on the order book, thus adding liquidity to the market and, as a result, being classified as a maker and charged a maker fee.

Winner: Gemini

Both platforms make purchasing crypto easy. Both allow you to connect a funding source through Plaid and both allow you to setup recurring buys. The whole process however is more streamlined on Gemini and the fact that you can automatically add your purchases to the earn program helps reduce fees as you earn back any said fees with their yield program.

Unique features of Gemini and Coinbase

Both platforms offer some unique features and product categories you should be aware of. So apart from the basic exchange features, what else do both of these excellent exchanges offer? Let’s find out.

Gemini Earn

One of the biggest selling points of Gemini is that you can earn interest on your crypto holdings. Not only does this help you earn back any fees associated with buying crypto they also offer a generous 8.05% APY on GUSD, their native stable coin.

The earn program like any lending platform does have risks of loss of your crypto, but keep in mind that it is optional if you don’t feel comfortable lending out your crypto.

Gemini credit card

Gemini has a credit card that is currently under a soft launch with emails being sent out to people on the waitlist with an offer to sign p. The credit card as no foreign transaction fee, 3% Bitcoin rewards on dinning, 2% Bitcoin rewards on groceries and 1% Bitcoin rewards on everything else. Last, there is no yearly fee for use of this credit card.

Gemini Institutional account

Gemini offers an institutional account for corporations, asset managers, wealth managers and liquidity providers. They have SOC 1 Type 2 and SOC 2 Type 2 certification performed by Deloitte & Touche LLP as well as ISO/IEC 27001 Information Security Management System (ISMS) by Coalfire.

The Gemini team has extensive experience in crypto, conventional capital markets, security and technology, allowing them to work with institutional clients and provide answers that meet their particular needs and goals.

Coinbase debit card

Coinbase offers a debit card that allows you to spend your USDC balance (the stale coin launched by Coinbase) for daily purchases. In addition, you can earn crypto rewards of up to 4% on your purchases.

Receive rewards for everyday spending in either Stellar Lumens (XLM) or Bitcoin (BTC). Currently the rewards rate is 4% for Stellar Lumens and 1% in Bitcoin.

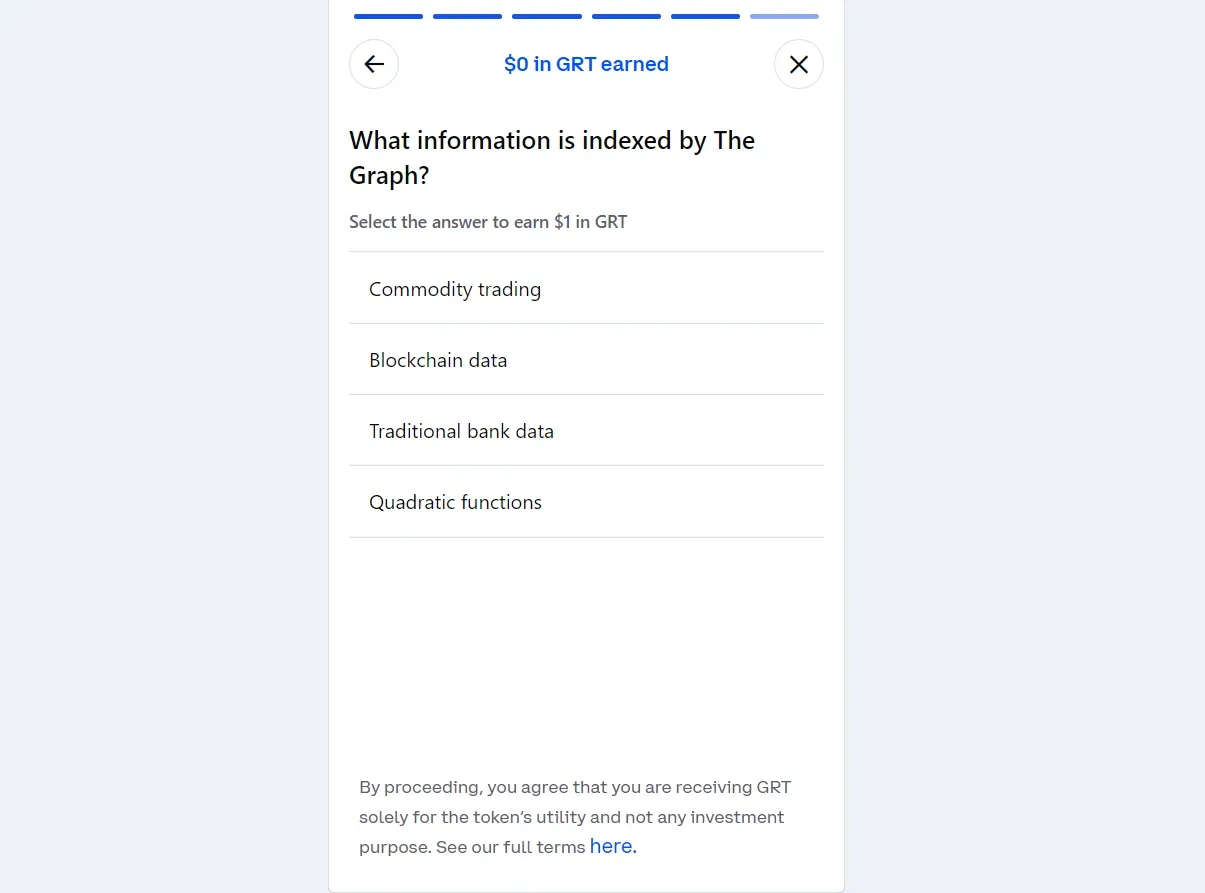

Coinbase Earn

Coinbase as an earn program, but it is nothing like the earn program from Gemini. Instead of getting a yield on your crypto holdings, you earn various crypto tokens through learning about crypto.

By completing quizzes you earn different tokens that are then deposited into your account. Of course you can always sell these tokens for cash and the use that USD in your account to buy Bitcoin if you like.

Coinbase Vault

Instead of an institutional account like Gemini, Coinbase offers a vault program for storing Bitcoin, Ethereum or any asset of your choosing long term. While I’m a big proponent of “not your keys, not your coins” and that I think you should self custody your own assets, I know it’s not for everyone.

With the Coinbase Vault feature they provide joint accounts with multiple users for extra security, requiring multiple approvers to initiate a withdrawal. Also, withdrawals from your vault have a 48 hour window during which they can be canceled. Last, 98% of digital currency is stored totally offline with Coinbase Vault in a geographically distributed safe deposit boxes and physical vaults.

Winner: Gemini

Gemini beats out Coinbase in every way. I would rather have a credit card and all the protection it provides over a debit card. I would rather earn 3% in Bitcoin than 4% in an alt coin. I also like that I can earn yield on stable coin, Bitcoin, Solana and other assets with Gemini in a way that is not possible with Coinbase.

Last, I’m quite impressed with the vault feature of Coinbase but the whole ethos behind Bitcoin is self sovereignty and that can’t be achieved if your Bitcoin is held in a custodial account, no matter how secure.

Customer Support

Customer support is critically important when it comes to any cryptocurrency exchange. Losing access to your 2FA app through losing your phone, not being able to log into your account, having a withdrawal issue and more.

When you have a problem that needs solving, you don’t want to be waiting for up to a week for someone to answer a support ticket. You’ll want live chat support, a phone number to call and various helpful knowledge base articles.

Gemini support

Gemini works by way of chat support. You go through the process of self selecting your issue through an AI chat bot. If none of the options are relevant to you, you can then choose to send an email to Gemini support. On average they reply within 24 hours Monday to Friday. Longer on the weekends.

Coinbase support

Coinbase offers all the support Gemini does with the added addition of a phone number you can call. On their support page you can self select the product vertical you’re calling about and answer a few questions to help support understand your issue or simply fill out a form to send an email or call.

Winner: Coinbase

Coinbase is an American based crypto exchange that has a much larger international footprint than Gemini which is more exclusively for Americans. As such, Coinbase is a much larger company and provides better support simply by being able to call someone and talk to a person.

Both exchanges provide fast support, but Coinbase does edges out Gemini through having a phone number to call.

Frequently Asked Questions

Now finally let’s address some frequently asked questions regarding both the Coinbase exchange and the Gemini exchange to make this review as comprehensive as possible.

Which is the bigger? Gemini or Coinbase?

Gemini currently has 13.6 million user accounts compared to a staggering 89 million verified users on Coinbase. Coinbase has a global reach, Gemini is more focused on regulatory compliance in the United States and aims to be your crypto bank.

Is Gemini a hot wallet?

Gemini is a cryptocurrency exchange where your funds are held in a custodial account. It’s not a hot wallet as a proper wallet is one where you have the private keys for your digital assets.

Is Gemini better than Coinbase?

If you’re an American citizen, Gemini is the better choice compared to Coinbase for their security and compliance with US regulations, their credit card and the ability to earn interest through Gemini Earn.

Both exchanges however are safe and secure and if all you’re looking to do is buy Bitcoin that bother are equivalent to one another.

Is it safe to keep Bitcoin on Gemini?

Gemini is a well regulated, audited, secure crypto exchange. It’s very safe to keep your Bitcoin on Gemini. However, as with any centralized exchange there are risks of hacks or government regulations affecting the movement of your Bitcoin. You should at some point learn to self custody your Bitcoin.

Is it safe to keep Bitcoin on Coinbase?

Coinbase is a well regulated, secure, audited, publicly traded company in the US. They offer a vault feature to help protect your Bitcoin holdings for the long term. However, as with any centralized exchange there as risks of hacks, the company going out of business or government regulations affecting the movement of your Bitcoin. You should self custody the majority of your Bitcoin holdings at some point.

Coinbase vs Gemini Conclusion

I compared Gemini to Coinbase by assessing similar features and distinctions, as well as customer support alternatives, security levels, and supported digital assets. Furthermore, I took into account the number of cryptocurrencies available for trading, fiat currencies accepted, and deposit and withdrawal options.

To narrow down the primary differences, I looked at things like standout characteristics unique to each platform, self-help instructions, and the popularity and simplicity of use for mobile apps.

Gemini

Create an account and buy some BTC today. Consider getting their credit card as well.