The Blockfi Rewards Credit Card - Why I Stopped Using It

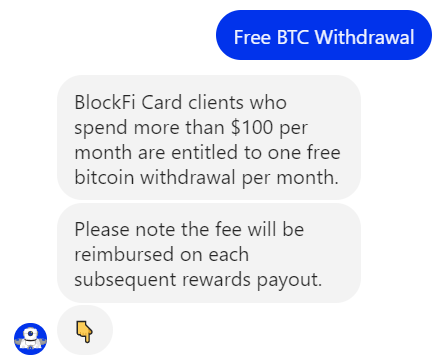

Update: Blockfi now provides 1 free BTC withdrawal per month if you spend $100 or more on the card. But there is still a catch. The fee is reimbursed with each subsequent rewards payment. So you'll never actually be able to withdraw all your BTC because you'll always have at a minimum, the Blockfi reimbursement sitting in your account.

Another Update:: Blockfi due to the FTX and Binance drama has now halted withdrawls of customer funds. I'm glad I stopped holding funds here months ago. I was able to get out my last $40 worth of credit card rewards at least.

— BlockFi (@BlockFi) November 11, 2022

Update again (!): The Blockfi credit card has stopped working. I can't use it even if I wanted to (which I don't since I can't withdraw any rewards so what's the point).

Blockfi from the get-go has always got a lot of criticism from financial YouTubers who were all shilling for the Celsius Network which has since gone bankrupt (oops). Blockfi however is still standing (for now).

Final Update: Blockfi has gone bankrupt lol.

I've made a decent amount of free Bitcoin from Blockfi as I had at one point $10,000 GUSD earning interest at 9% that was paid out in BTC, their credit card that paid out rewards in BTC and the BTC I held on Blockfi earning interest as well.

This all seemed to be too good to last so when Blockfi was fined 100 million dollars, it was obvious the party was over and was time to pull out all my funds ASAP. In addition, I decided to pull of my BTC from everywhere before the summer as the markets seemed primed for a crash.

Good thing I did since the Voyager app (which I used for trading shit coins) went bankrupt too.

The Blockfi rewards credit card is useless now

When I first got the card it paid out 3.5% on all purchases for the first 3 months (capped at earning $100 in rewards), then it paid out 1.5% on everything and if you happened to spend over 30K using the card your bonus increased to 2%.

Overall, it used to be a decent "everything else" cash back card. Earn a decent amount of BTC, let it accumulate a bit for a few months and then withdraw it into cold storage.

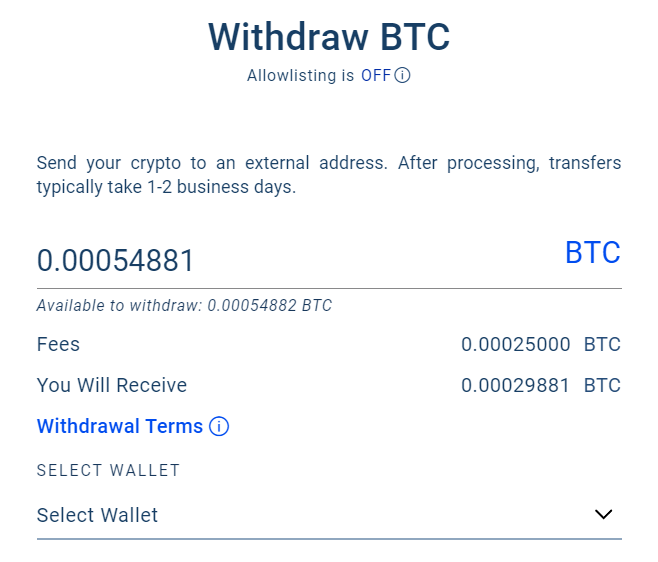

Blockfi also used to allow one free withdrawal per month but they have changed this and now charge .0025 BTC to move BTC off Blockfi.

Your rewards are cut significantly

The problem with Blockfi charging you a fee to move the BTC (or any digital asset you're earning in) you earned through using the card is that it cuts into the amount of the reward.

For example, I had $11-13 worth of BTC at the current price I earned from using the card from the last 2 months.

If I want to withdraw it, half of the rewards from the credit card are eaten up by fees. Defeating the whole point of a Bitcoin back card which is to stack stats.

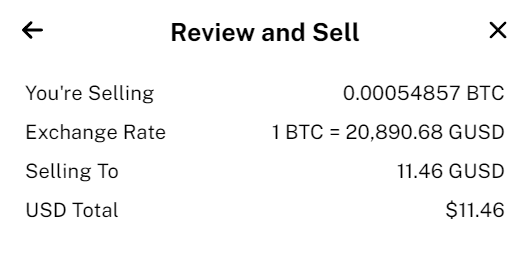

Why not sell the BTC for cash or earn in a stable coin?

If you tried to sell your BTC you can only swap it for another crypto currency or stable coin. You can't actually sell it for cash and withdraw it to your bank account like you would assume.

So GUSD is Gemini's current stable coin and one of the most trustworthy stable coins around.

$25.

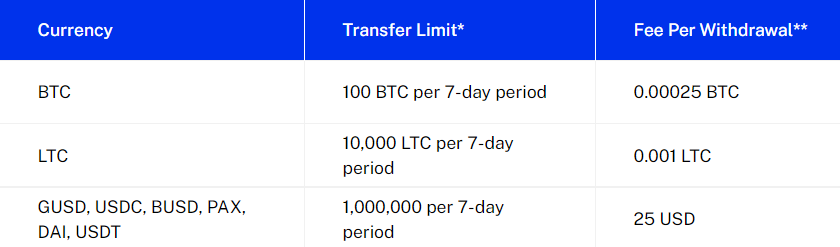

You have to pay $25 to withdraw GUSD:

Well this makes this credit card functionally useless as a viable cash-back card. If you spend let's say $500 with this card, you're earning roughly $7-8 worth of value. So it takes 4 months or more to earn 25 USD in rewards which you then need to pay to Blockfi to actually claim your rewards.

So what's the point?

I'm retiring my Blockfi rewards card

I've had nothing but good experiences with Blockfi. I've never had an issue withdrawing funds, I've earned almost $1K in free Bitcoin but all good things come to an end.

I smartly kept my Blockfi as my backup card before they went under.

This actually came in handy right before my trip to Europe with my main travel card getting a fraud alert literally a day before I was leaving. So I ended up having to use Blockfi for that trip. Annoying because I missed out on thousands of points I could have earned but it's better than withdrawing cash from an ATM.

There card became useless

The card started out strong but their rewards card is not competitive at all anymore.

The whole point of a cash back card is to earn cash to spend. But Blockfi eats all your rewards up with fees, so why bother using it?

My current "everything else" card is now the Gemini rewards card which I'm quite satisfied with. Earn rewards in BTC, stable coin or another currency of your choosing in real time at the market rate upon your purchase.

I suggest earning BTC or the Gemini dollar.

The withdrawal fees for BTC are lower on Gemini and the Gemini dollar (GUSD) allows you to earn a generous interest using Gemini's Earn program. To withdraw GUSD you'll need to sell if for USD. This process you will have to pay a small fee but it's not $25 like on Blockfi!